Our Investment Philosophy

When it comes to investing, Worth Advisors understands that a cookie-cutter approach fails to bring the best results. That’s why we emphasize customized plans based on your unique needs, objectives, and concerns. And we learn this the old-fashioned way: by talking to you.

Worth Advisors believes in a diversified approach that incorporates many investment vehicles, including individual stocks, mutual funds, exchange-traded funds (ETFs), bonds, closed-end funds, and even cash. A balanced approach provides more protection from market volatility, while allowing you to profit from investment opportunities you otherwise would have missed. And we’ll construct your portfolio to be tax-friendly, which can make a substantial difference on your net returns.

Having the correct investment portfolio can make a significant impact on the success of your retirement. It’s critical for you to trust your investment strategy to a firm with considerable experience in the financial markets. Why not contact us today to begin the conversation?

We believe that the foundation for successful investing is a well-diversified portfolio that provides flexibility in the face of changing markets and economies. We invest for the long-term, while striving to maximize returns and minimize risks.

Disciplined Approach

Implementing an investment strategy based on your goals and risk tolerance

Risk Management

Identify and manage industry, sector, and market exposure

Choice of preselected optimally blended portfolios

Targeted to a specific investment objectives

Tactical Allocation

Designed to enhance returns within the overall portfolio

Two Investment approaches

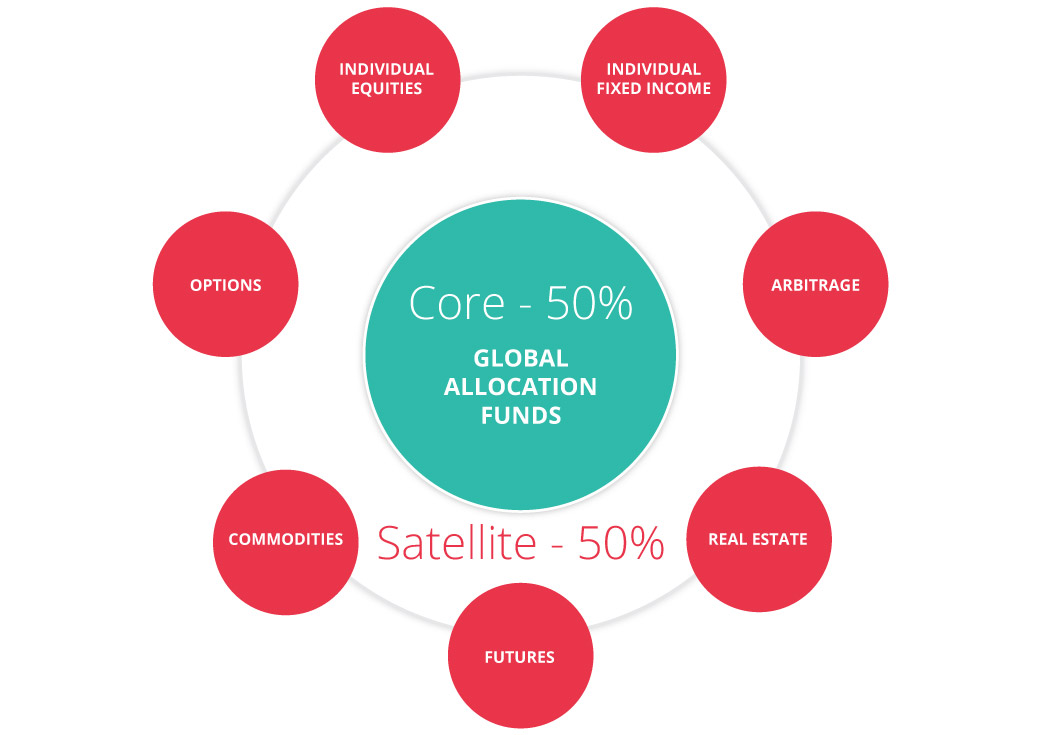

Core Satellite Portfolio

Portfolios constructed to minimize costs, tax liability and volatility; while providing an opportunity outperform the broad market.

The Core of the portfolio consists of Exchange Traded Funds (ETFs) which track major market indices (ß), while Satellite positions have the potential to deliver higher returns (α).

Minimum Investment: $500,000

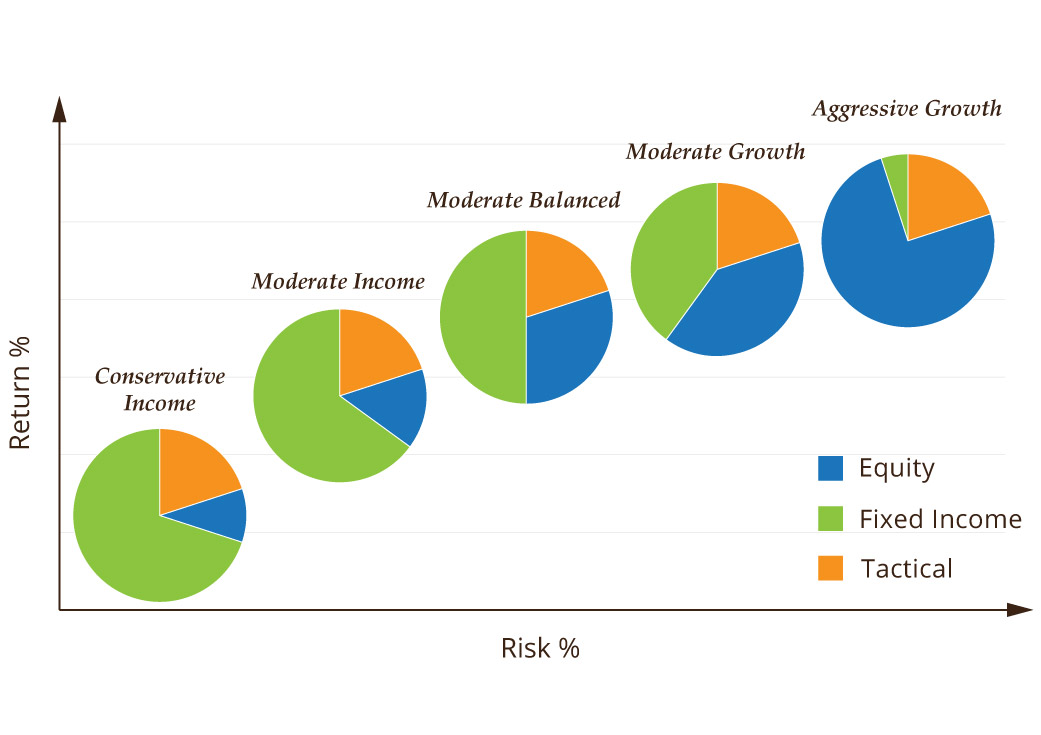

Model ETF Portfolio

The Worth Advisors Model ETF Portfolios provide a range of risk and return levels utilizing a tactically driven, global investment strategy. The portfolios seek to combine the best characteristics of tactical, strategic and dynamic asset allocation to deliver favorable risk adjusted returns over time.